Breaking news

NFT Tax Deductions: How Worthless NFTs Can Still Save You Money on Taxes

NFT Tax Deductions: Worthless NFTs may be used for tax deductions. Learn IRS rules, NFT donations, and tax‑saving strategies for worthless NFT.

Las Vegas, NV – August 5, 2025 — In 2021, NFTs were selling for millions. Today, many of those once-coveted tokens are sitting in digital wallets with no bidders, no resale market, and effectively no value. But here’s the twist: even “worthless” NFTs may still carry financial power—not on OpenSea or Blur, but in the world of IRS tax deductions.

The IRS Calls NFTs “Digital Assets”

The Internal Revenue Service has been playing catch‑up with the NFT boom and bust. In its most recent guidelines, the IRS made one thing clear: NFTs are digital assets and treated as property, not currency (irs.gov). That means NFT sales, trades, or disposals must be reported just like selling stock or real estate.

If you sold an NFT at a profit, you owe capital gains tax. But what if that JPEG monkey or virtual sneaker collection collapsed in value? That loss could be your ticket to a tax break.

How NFT Donations Work for Tax Deductions

The IRS allows individuals to donate NFTs directly to charities registered under 501(c)(3)—and that donation can be deductible.

- Held longer than 1 year: Donors may deduct the fair market value (FMV).

- Held less than 1 year: Deduction is limited to the original purchase cost (basis).

The charity then reports the donation on its annual tax filings. If the NFT is sold within three years, the IRS requires additional forms (Form 8282) and a notification to the donor (mwe.com).

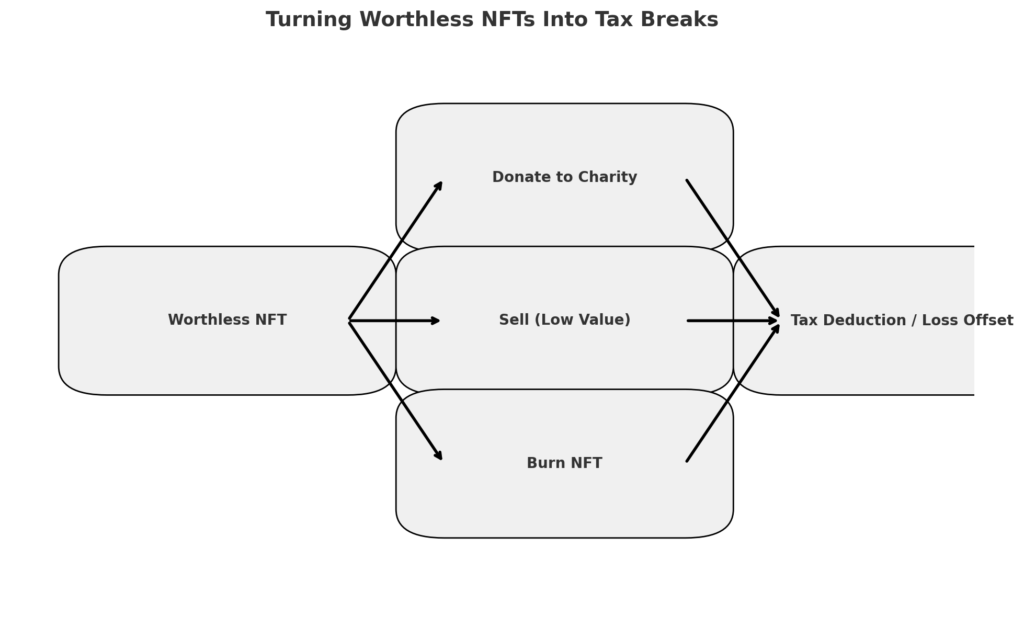

Turning Worthless NFTs Into Tax Breaks

The NFT market crash left thousands of projects abandoned. Some holders are using tax‑loss harvesting: intentionally disposing of NFTs that no longer have a market value to claim a capital loss, which can offset other taxable crypto or stock gains (koinly.io).

Ways to do this include:

- Burning the NFT—sending it to a dead wallet.

- Selling for pennies—disposing through a minimal marketplace transaction.

- Donating to a charity—where even an illiquid NFT can qualify for a deduction with the right paperwork (tokentax.co).

Here’s the key: If you can show the NFT is truly worthless, you may still deduct your original cost basis. For high‑value NFTs, the IRS may require a qualified appraisal and Form 8283 (gordonlaw.com).

An Investor’s Example

Imagine you bought a digital collectible for $8,000 during the NFT craze. Today, it has no buyers. Instead of writing it off as a total loss, you donate it to a recognized charity. You’ve held it for over a year, and while its market value is effectively zero, your paperwork may still support a deduction based on its cost basis—reducing your taxable income.

Pair that with a capital loss from another NFT disposal, and suddenly, what looked like a dead investment turns into a two‑fold tax benefit.

The Collectibles Question

There’s one wrinkle: the IRS is still considering whether NFTs should be taxed as collectibles (like art, stamps, or gems). If classified that way, long‑term gains on NFTs could face a 28% tax rate, instead of the standard 20% for capital assets (investopedia.com).

This means future guidance could affect how NFT donations and losses are valued and whether deductions get capped differently.

What Donors Should Remember

If you’re planning to turn an unwanted NFT into a tax break:

- Confirm charity status—only IRS‑recognized 501(c)(3) organizations qualify.

- Document everything—appraisals, forms, and donation receipts.

- Mind the holding period—short‑term NFTs mean smaller deductions.

- Separate personal vs. investment NFTs—personal‑use NFTs generally don’t qualify for deductions.

Why This Matters Now

The NFT crash has left many digital wallets full of illiquid tokens. Instead of deleting them in frustration, smart investors are finding ways to turn losses into deductions. At a time when crypto tax enforcement is tightening, NFTs may be a surprising way to give back to charity—and save money at the same time.

NFTs may no longer dominate headlines, but even a worthless token could lower your tax bill. As with any tax strategy, consult a professional before making moves—and turn today’s digital losses into tomorrow’s financial wins.

Prince Adeyemi is the Editor-in-Chief and an investigative journalist known for his sharp coverage of technology, entertainment, and current events. With a commitment to accuracy and depth, he delivers insightful reporting on business, sports, government, and celebrity news.

Based in Las Vegas, Prince leads coverage that extends across Henderson and beyond, providing readers with trusted, timely, and engaging stories. His dedication to high-quality journalism ensures that audiences stay informed on the issues and events shaping their communities and the wider world.

Leave a Reply